Setting Up a Secure Payment Gateway: The Ultimate Guide

You have some crucial choices to make as a small business owner. You may have been conducting business thus far using conventional payment methods like cash, credit cards, and debit cards. But times have changed, especially since the virus that has taken us all and forced everything online. More than 80% of the payments in this frenzied hunt take place online today. A payment gateway is essential to the proper operation of the payments ecosystem because it makes it possible for customers and businesses to make online payments.

Customers all over the world are looking for a more secure method of payment, and small businesses like yours are looking for ways to get paid more quickly. However, unlike purchasing a coffee maker, a payment gateway cannot be purchased at a store. Before investing in a payment gateway for your small business, there are a few things to consider.

You will discover how payments operate in this article, along with a number of things to think about when choosing a payment gateway for your small business.

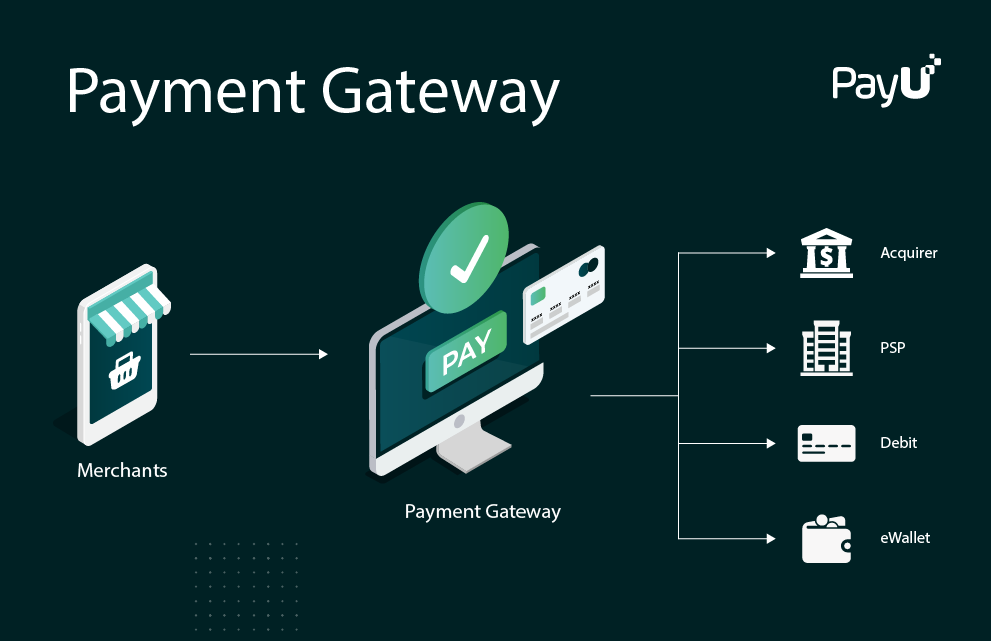

101 Payment Gateway

Payment processors and payment gateways are two different things. Although they are technically different, certain payment processors can also act as payment gateways.

A payment gateway acts as a go-between between the merchant bank and the payer’s bank (the issuing bank). Although it does not actually process the payment, it makes it easier by reminding both banks and informing the issuing bank and the business about the payee, receiver, and payment information. The payment gateway also informs both parties of the payment’s status.

A payment gateway is essential to the proper operation of the payments ecosystem because it makes it possible for customers and businesses to make online payments. Online sales reached $5.7 billion in 2022 as a result of the Covid-19 outbreak, according to Statista. The loss from payment-related fraud, which increased at the same period and will total $41 billion in 2022, is also on the rise. A payment gateway is a crucial tool for addressing the challenges of processing payments online while maintaining a quick and secure checkout process in light of these statistics.

If you operate an online store, you don’t have to be an expert in payment gateways, but it still pays to understand the fundamentals of how money moves online from a customer’s credit card to your bank account. Join us as we discuss what a payment gateway is, how it functions, its security features, and how to select the payment gateway service that is best for your company. Additionally, we provide you with priceless insights into this crucial technology for your payment processing in our video on how a payment gateway operates.

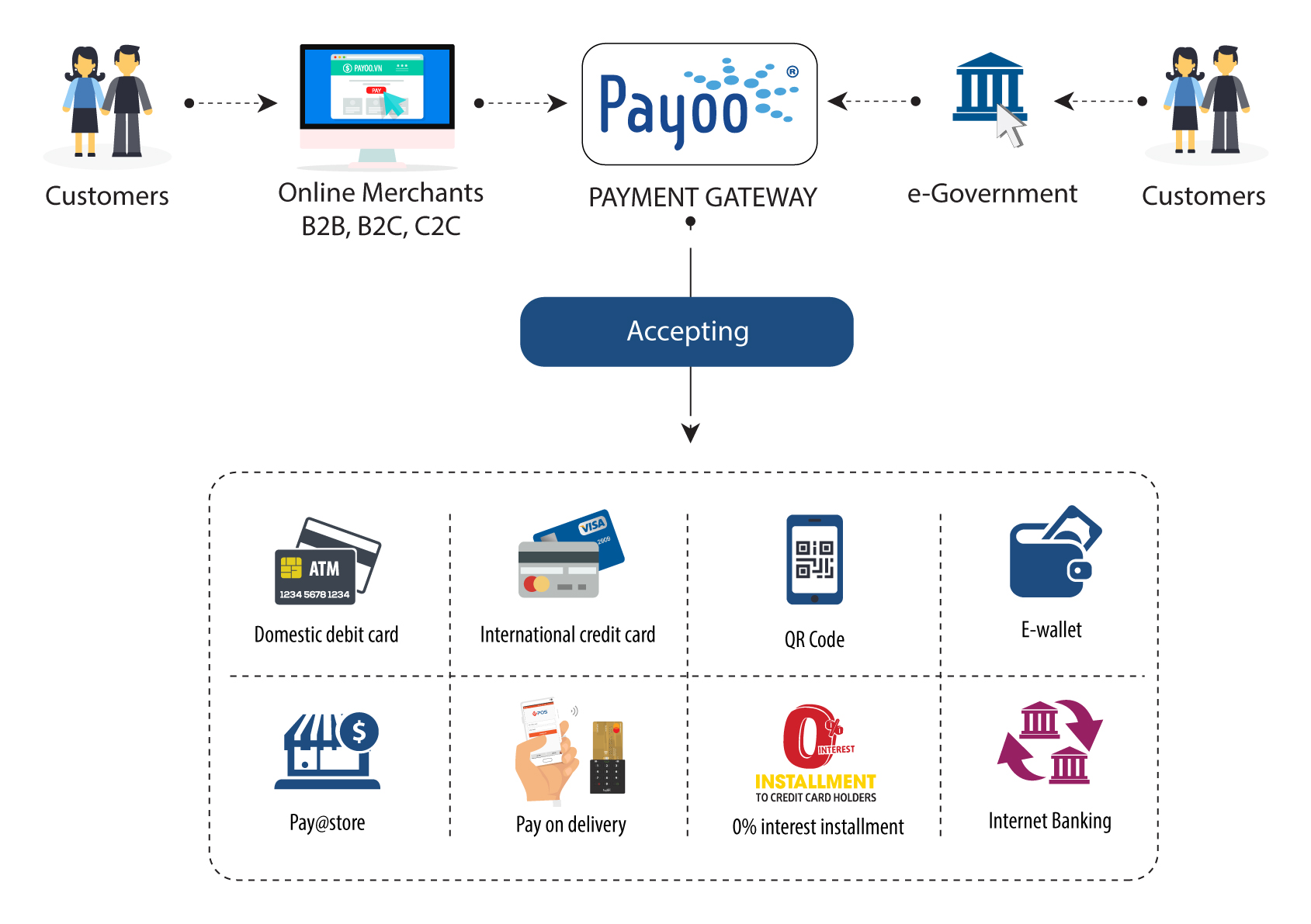

The major participants in online payments

Let’s first identify the major participants in online payments before we get into more detail about what a payment gateway is. There are several important parties participating in the payment process when a consumer clicks the “Pay” button on your website (if you want to learn more about the various entities taking part in the transaction flow, check out our video here):

- The merchant is an online company that accepts credit cards, works in any industry (such as travel, retail, eCommerce, gaming, forex, etc.), and provides customers with physical or digital goods or services.

- The person who accesses the goods and services the merchant is selling and starts the transaction is the customer (also known as the cardholder).

- The bank, financial institution, business, or credit union that issues or assists in providing payment cards to clients on behalf of the card schemes is known as the issuing bank or the issuer.

- The financial institution that manages the merchant account while processing card payments on behalf of businesses is known as the acquiring bank, or acquirer. One of its primary responsibilities is to safely send card payment information to the card schemes (more on this below) for issuer authorization.

- The technology used by retailers to validate and securely transport payment data between the many parties involved in the transaction process is known as the payment gateway. The payment gateway notifies the merchant when the payment has been accepted or rejected by the parties concerned.

- Card schemes are the organizations that facilitate payments between card issuers and retailers. Mastercard, Visa, American Express, Discover, and UnionPay are a few of the widely used international credit card programs.

A payment gateway is what?

A payment gateway is a piece of transaction processing software that collects, saves, and sends consumer credit card data to the acquirer. The customer is then informed of the payment acceptance or decline. To put it another way, the payment gateway serves as a go-between for customers and businesses. An online payment gateway can make it easier for merchants to receive card payments by serving as an interface between their website and their acquirer.

A payment gateway encrypts the sensitive payment information of the client when it is transmitted from the merchant to the acquirer and ultimately the issuer. The gateway adheres to the PCI-DSS compliance standard’s tight guidelines for data security, which also involve yearly audits and recertifications to guarantee the standard’s validity (more of this below).

What is the operation of a payment gateway?

Now that you know why a payment gateway is essential for retailers, let’s examine how it functions during the payment process. This also comprises the actions conducted during the authorisation, capture, and settlement phases of credit card processing.

- The customer moves on to the payment page of an eCommerce website after choosing the goods or services they wish to purchase. The majority of payment gateways provide a variety of checkout page alternatives. The payment gateway from emerchantpay provides customized choices for your payment page that suit your company’s requirements. (Our essay and video on the subject will teach you everything you need to know about the various integration possibilities.)

- On the payment page, the consumer inputs their credit or debit card information, including the name of the cardholder, card number, expiration date, and card verification value (CVV) number. Depending on the merchant’s selected integration, this information is securely sent to the payment gateway (hosted payment page, server-to-server integration, or client-side encryption).

- Prior to delivering the card data to the acquirer, the payment gateway encrypts the card information and does fraud checks.

- The card schemes do additional fraud checks on the data that the acquirer securely submits to them, and they then pass the payment data to the issuer for payment authorization.

- Authorization – After conducting the appropriate fraud screening, which includes validating the transaction information and making sure the cardholder has enough money to make the purchase and/or that the bank account is legitimate, the issuer authorises the transaction. The acquirer receives the issuer’s approved or refused payment notification from the card schemes.

Notification

- The payment gateway receives the approval or deny notification from the acquirer and relays it to the merchant. Depending on the message, the merchant may either provide a page for the customer to confirm their purchase or request an alternative form of payment.

- Card capture requests allow the merchant to “capture” the amount of the purchase from the customer to the merchant account after the authorisation process is complete. Although the money are reserved and the customer’s card limit is decreased, they won’t be charged until the capture has taken place.

- Settlement: If the transaction is accepted, the acquirer will receive the payment amount from the issuing bank and deposit it in the merchant account as “on hold” (more on the merchant account below). Depending on the agreement the business has with their payment service provider, the actual settlement date will vary.

- A payment gateway has advantages for both merchants and customers, even if the majority of its operations take place in the background during the payment process. Each of the aforementioned processes can occur instantly or after a brief delay.

Characteristics of a payment gateway’s security

Payment gateways’ top priorities include security, compliance, and handling private payment card data. However, as we discussed above, just as digitalization has made eCommerce sales successful, it has also made online businesses and their clients more exposed to hackers. The global cost of online payment fraud is projected to reach $48 billion by 2023, making payment gateway security all the more crucial.

Having the appropriate payment gateway on your side is a terrific place to begin when investing in reliable risk management solutions that can assist in identifying and discouraging online fraudulent transactions. To assist you in selecting the best payment gateway for your eCommerce shop, we’ve listed a few of the security precautions used by each.

PCI DSS conformity

A group of international security guidelines known as the Payment Card Industry Data Security Standards (PCI DSS) are used by card systems. The PCI DSS was created to protect debit and credit card transactions and stop the misuse of cardholders’ private data. To effectively prevent fraud, companies that receive, store, process, and send sensitive card information must be PCI compliant (watch the video below and stay in the loop about all things PCI compliance).

Tokenisation

Payment gateways also utilize tokenization to safeguard users’ credit card information. During the transaction, a token—a distinctive identifier—replaces the private bank card information. In other words, if someone tries to intercept your data before it gets to the safe decryption endpoint, they will only see an incomprehensible form.

Tokenization enables customers to just enter their card information once, eliminating the need to enter the same information again for subsequent transactions. Because there is one less step for customers to complete during checkout on the merchant’s website after the initial transaction, using this technology enables retailers to provide smoother and safer payment experiences for their customers.

Third-party verification

An authentication mechanism called 3D Secure is designed to reduce fraud and increase security for online card payments. After entering their payment card information during a transaction, clients must complete a second two-factor verification step with the card issuer to confirm the payment.

Payment processing is made safer and easier across a variety of devices with the use of 3D secure payment gateways. By October 2022, Visa and Mastercard said they would stop supporting the 3D Secure 1 protocol internationally and only offer 3D Secure 2, which is an improved version of 3DS1. It should be mentioned that starting in October 2023, card schemes will require retailers in Bangladesh and India to upgrade to 3DS2.

What function does a merchant account serve?

An exclusive bank account called a merchant account required in order to take debit/card and electronic card payments. These accounts, which can issued by organizations like acquirers, payment gateways, and payment service providers, enable companies to quickly and safely accept payments from clients. The commercial bank account that retailers use for regular purchases is not the same thing as a merchant account, though. Having a merchant account shows that the business the owner of the payment information sent to the bank and the recipient of the money from the online transactions.

The money from a customer’s payment deposited in the merchant account by the payment gateway (or the organization that sets up the merchant account for you). Because of this, merchant accounts required from the point where customers submit their card information to the point where the acquirer deposits monies into the business account.

In essence, a merchant account streamlines the payment process by collecting payments through your payment gateway and combining them into a single deposit to your bank account.

Allowing many currencies through your payment gateway

When accepting international payments, which requires that your company bill clients in more than one currency, payment gateways that support various currencies are an essential component of your business’ eCommerce infrastructure (e.g., in British pounds, euros, etc.). Online retailers can implement multi-currency pricing (MCP) on their website with the help of emerchantpay to expand smoothly around the world. This is due to MCP’s ability to let firms set prices and charges in a variety of international currencies while still getting payment (a procedure known as settlement) and reporting in their home currency.

You can: using a payment gateway that accepts payments in various currencies:

Increase customer trust and conversions: According to a survey by The Payers, 73% of international consumers feel more at ease making a purchase from a company if the price is displayed in their preferred local currency. By integrating a single payment gateway with the same merchant account, you may increase your sales and profitability by accepting payments in other currencies.

Obtain a competitive edge – You have a tactical advantage over your rivals if you accept payments in the preferred currency of your target market.

How to select the most effective payment gateway for your company

Payment gateways may seem complicated, but they don’t have to be if you work with a reputable and knowledgeable acquirer and payment service provider. With emerchantpay, which has more than 20 years of experience in online payment processing, you can be confident that you’re giving your consumers a simple and enjoyable payment experience. In addition to maintaining annual PCI Level 1 compliance, we take pleasure in our one-stop shopping strategy. By doing this, we are able to provide you with a versatile, user-friendly payment platform that consists of card issuance, global acquiring, alternative payment methods (APMs), payment gateways, and internal risk and fraud management services.

Utilizing our all-in-one payment system, which was created for today’s picky consumers, will put you in a good position to offer seamless and secure checkout experiences to your clients for increased income.

Why are payment systems used?

When a payment is successful, a payment gateway processes the transaction in three steps.

- The payment gateway examines and confirms the card information of the payer.

- Determines whether the payer has enough money on hand to cover the payment.

- Conveys whether the payment has been approved or denied.

How do internet transactions work?

You must have a thorough understanding of how payments function with the touch of a button if you are a small business owner wanting to accept payments through payment gateways. Having a firm understanding of this can assist you in choosing a payment gateway.

Payment processing happens in two steps. The first step is authorisation, and the second is settlement. In essence, the payment is authorized, and the real payment is made at the settlement phase.

Let’s examine each stage in more detail.

The data is transferred to the payment gateway when a customer clicks the checkout button on your e-commerce site or the payment link. The data is read by the payment gateway before being sent to the payment processor. The payment processor asks the customer’s bank to approve the payment as soon as it receives this information. The bank confirms the payment request and often sends the consumer a confirmation request with an OTP. The authorisation portion is up to this point.

In the settlement phase, the payment processor transfers the funds to your account after the bank has verified and approved the payment request. Online payments function in the same way.

These entire processes take place in a matter of seconds.

How should a payment gateway be chosen?

You risk losing out on repeat business and potential customers if the payment gateway is inconvenient for you or your clients. Because of this, you must choose a payment gateway for your small business carefully.

Here are a few things to think about before selecting your payment gateway.

Accepted card types

Cards are the most used form of payment worldwide. Therefore, you must ensure that your payment gateway accepts all card kinds seamlessly in order to keep clients. When you have a sizable local customer base, your payment gateway needs to accept the cards that they are familiar with. You must be allowed to accept payments using Diners Club cards if your company is located in an area where they are used the most frequently.

Holding period

Payments from the customer’s end can happen quickly. Payment gateways occasionally do retain the payments for a few days, though. The gateway determines the holding period, which might range from one to seven days. But don’t consider this a drawback. You benefit from the hold period in the event of refunds and chargebacks. Select the option that best suits your needs.

Security

As technology advances, so do the quantity of fraudulent activities. Therefore, it is your duty as a small business owner to maintain the security of the payment process for both you and your consumers. Each payment gateway has its own set of security requirements. Ensure that it has fraud detection and other security capabilities before you choose.

Support for multiple currencies

You may reach customers worldwide if you have an online store. Multicurrency transactions are required for international clients. Therefore, if your company operates internationally, you should pick a payment gateway that supports multi-currency transactions. The payment gateway cost for each multi-currency transaction is also something to keep an eye on.

Portability

A payment gateway has not traditionally considered data portability as a feature. However, if your business grows and you need to alter your payment gateway, this option can come in handy. You can move your transaction data with ease using payment gateways that allow data portability. But if your payment gateway does not offer data portability, you shouldn’t be concerned. To sync your ongoing and past transactions into QuickBooks, you can use third-party tools like PayTraQer.

How do payment gateways help your small business?

Increased client satisfaction

Any business’s primary focus should be its customers. Customer happiness is heavily influenced by how simple and convenient it is for them to buy from you.

When clients cannot find their typical payment options, it is disappointing. Payment gateways have a better chance of winning this game than archaic cash or card payment methods since customers want quick and frictionless payment alternatives. Payment gateways are simple, practical, and quick. Better payment options give you the advantage over your competitors.

Convenient recurring payments

The capability of recurring charging is provided by payment gateways. You may automatically send bills and get paid quicker on the go if you give your consumers monthly, bimonthly, or even annual subscription options.

Payment gateways employ auto-debit mechanisms to create bills and transmit money automatically on predetermined dates, as specified by your customer. You can easily keep track of your bills and get paid more quickly.

On the go payment

Anyone with a smartphone can access your website and accept payments from anywhere. Make sure your payment gateway enables multi-currency transactions if you are selling goods internationally. If so, it is a clean way to get paid because the payment gateway handles all conversion costs. However, you need to look into the gateway cost for payments from abroad.

It is a simple method of payment for your local clients as well as for foreign customers. They don’t need to come into your store and stand in line to pay their bills. They have access to play anytime, anyplace, with just a single tap.

Payments are quick and simple

Payment gateways allow you to receive payments immediately and without any issues, regardless of whether you operate an online store or a small local brick-and-mortar business.

Simply provide a payment link to your consumer, and they can pay you directly by clicking the link with no hassle. While your clients can place orders via phone and text, you can also offer them payment links by email, WhatsApp, or even text messaging. On the go payment is possible.

Secure and safe payments

As a business owner, you’ll be searching for a quicker method of payment, while your clients are seeking a safe and secure method. Strong data security is provided by payment gateways. The gateway safely encrypts the data after it has safely scrambled once a payment has initiated.

The majority of payment gateways include fraud detection tools and use cutting-edge technology to protect sensitive consumer data.

Simplified bookkeeping

Payment gateways simplify not only the process of making payments but also that of bookkeeping. You can use a payment switch to automate the transfer of other transactions to designated bank accounts and your incoming payments to the appropriate bank.

Additionally, since every payment made online, you will have digital records for every dollar that enters and exits your account. Your bookkeeping will be simpler and more effective as a result of this improved payment flow. Double entry or manual keying are not necessary.

Even better, you may use third-party integration solutions to link your payment gateways to your accounting software and automatically transfer your transactions into it. For instance, if you use QuickBooks, PayTraQer can integrated with your payment gateway to automatically record your transactions as they happen in real-time.

Here are some guidelines for small businesses accepting online payments

Provider of online payment services

A service provider for your online payment solution would be the typical way to take payments from your clients. And customers if you operate a business that sells actual goods or services online.

For instance, both small and large businesses use PayPal and Stripe. Two of the most well-known and widely used payment service providers worldwide.

However, if your company falls under eCommerce through one of those platforms. You can also use the processor built into Shopify or WooCommerce.

With website builders like Squarespace and WordPress, payment service providers may integrated with ease. To begin accepting payments for the services and products you supply. All you need to do is sign up on the website of either payment service provider. And then enter that information into the freshly created website you developed.

Online payment solution providers also give you the option to accept payments made with credit or debit cards. As well as payments made straight from your customer’s account. And the service provider to your account using net banking.

Anyone can open an account with a payment service provider, and there zero cost for doing so. Regardless of the type of business you are in.

Depending on the platform, you will have to pay a fee of about 3% for each transaction. Additionally, many POS systems provide eCommerce modules that accept online payments.

ACH transaction

A network that digitally moves money between US bank accounts called ACH, or Automated Clearing House. In other words, if the consumer made a direct payment, this typically how you get paid. Additionally, no particular requirements must completed in order to accept payments via ACH transfer.

Giving your consumers and clients the details of your bank account. Which normally includes the account holder’s name, account number, bank branch name, etc., is all that required.

Banks occasionally ask for a cancelled or canceled check to double-check account information, such as account number, bank branch, etc. Or permission from the bank itself. Usually, a straightforward voided check will do.

The consumer making the payment is responsible for having the necessary information. Including a supplier of ACH payment services like Stax or Gusto.

Additionally, just like a credit card transaction where the consumer covered the additional fee as a fee for the recipient. The customer or client will likewise be responsible for paying the fee for an ACH transfer.

Despite this, you could use your own account to receive ACH payments through Stripe. They impose a fee of 0.08% on every $5 transaction. The customer must also use the Plaid network to link their bank account.

Cellular payments

Making digital payments with a smartphone is incredibly handy for users of mobile wallets like Apple Pay, Google Pay, and Samsung Pay. To prevent clients from having to repeatedly enter the same information, all bank account-related data saved in the applications.

You just need to follow the developer integration instructions for each of them. To begin accepting mobile payments on a website that you are building from scratch.

Billing and invoicing

You can use an invoicing platform or bill payment solution. That allows one-click payments directly from an email to make it simpler. And easier for your consumers to pay for the goods or services they got. Regardless of whether your company sells products or services.

Xero, QuickBooks, and Zoho are a few of the well-known platforms for creating invoices. Every single one of these platforms offers integration with well-known payment service providers. You may just email the bill to your clients, and the platforms construct messages. With payment buttons to nudge them toward immediate payment.

Conclusion

By this point, you should fully comprehend how payment gateways operate. And how to pick the best one for your small business. Do your homework and decide what suits you the best.

Even though there is little doubt that the benefits of digital payments exceed the drawbacks. Some small firms are still debating them. The two most notable drawbacks are costs and data management.

Unlike checks, most digital payments need to sent through a third-party platform. Which occasionally takes a percentage of your sales as processing fees. This brings us to the final disadvantage, data management.

If you are using a self-hosted payment gateway, you are obviously in charge of protecting your clients’ financial information. One solution to the issue is to use hosted payment gateways or payment service providers.

Despite the drawbacks, offering digital payments to your clients speeds up and simplifies the process. There are many different online payment platforms available today. Making it simple to pick the one that best suits your needs, your budget. And the level of protection you want to provide your clients.

Play Dinosaur Game in your free time to relax and have some fun.